- Home

- Knowledge Insights

- From Bad to Worse: Understanding and Supporting Colombo’s Urban Poor Families in Crisis

Click here for PDF. of this article.

Low-income settlements in Colombo experienced greater food insecurity even before the pandemic, with 72% of households being food insecure[1]. Women in low-income households in Colombo were more likely to be underweight and overweight[2], with higher instances of blood pressure, diabetes, heart disease and anaemia when compared to their rural counterparts. Low dietary diversity and poor nutrition among the urban poor was largely attributed to the high cost of living in Colombo, with both food expenditure and non-food expenditure being more expensive in Colombo.

In 2018, the cost of a diet that met the nutrient requirements of a family of five was over Rs. 17,000 per month[3]. Another study calculated that meeting the government’s suggested diet would cost an individual in Colombo Rs. 215 a day[4], which would bring the monthly cost for a family of five to an eye-watering Rs. 32,250. The exorbitant cost of nutritious food is an issue that preceded the pandemic and economic crisis.

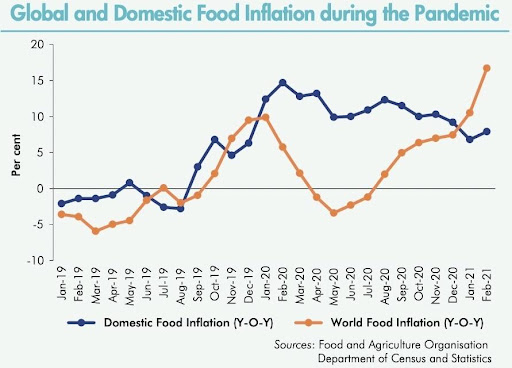

The onset of the COVID-19 crisis in 2020, disproportionately affected working class poor households in Colombo. Many who relied on daily wage work were no longer able to go to work following the impositions of lockdowns, which resulted in many households losing their access to income. Not only did this reduce their cash in hand to spend on food, but was also exacerbated by high food inflation, making food even less affordable to households. A report by the Central Bank[5] highlighted higher domestic food inflation in Sri Lanka compared to what was being experienced globally. In addition to food related expenditure there are also other monthly expenses that stress the already stretched household budget like utility bills, rent, mortgages, vehicle leasing, loans, children’s education and tuition, transport, medicines etc.

Limited support by the Government meant that Colombo’s low-income families had to dip into their savings, or make do with what they had. Families in Seevalipura (Wanathamulla), said they only got one cash handout by the Government of Rs.5000, which wasn’t enough to sustain them for a long period of time.

Global and Domestic Food Inflation during the Pandemic (CBSL Annual Report, 2020)

Two years later, the economic crisis has undone whatever recovery was made since COVID lockdowns were lifted. A sharp increase in the price of gas means that many households have switched to cheaper, alternative methods of cooking. Some houses switched to kerosene, but now find that they cannot spare the time to stand in kerosene queues for long periods of time in order to acquire it. The wood-fire stove was also an option considered by many households, however, given the spatial limitations in their houses, along with the strong fumes that are emitted from wood-fire stoves, it was deemed unsuitable for most. The most popular choice for many households is the rice-cooker, with many cooking all their meals, including tea in the rice cooker. However, for houses with arrears in electricity bills from the COVID lockdown period when they did not have the ability to pay, a rice cooker represents a higher electricity bill – a luxury not many can afford. Some houses have seen a doubling in their electricity bill since they started to rely on the rice-cooker for their meals.

Food inflation reached a record high of over 30% in April, a figure that hasn’t been seen in Sri Lanka since August 2008[6]. The diminishing value of money has made it even more difficult for low income families to afford healthy and nutritious meals. This could have serious repercussions for food security of the urban poor, worsening the severity of insecurity faced by some, and pushing more households to food insecurity. The longer term impact of this on health, and productivity have yet to be seen, but is likely to be severe, especially at a time when medicines and medical equipment are in short supply.

The shortage of fuel has also resulted in many not being able to afford transport. Families that rely on transport to commute to work, or to take their children to school, are also looking for alternative ways to travel or to cut back on items of expenditure such as these.

The economic crisis has affected families in a myriad of ways. Below, represents two case studies of families in Wanathamulla who are navigating the current economic crisis in different ways.

Case Study 1: Kanthi

Kanthi is 55 years old and lives in Wanathamulla, with her husband and son. Her daughter lives in an annexe adjoining their house, with her husband and son. Kanthi bears the expenses for both households, including her grandson’s schooling, whilst also cooking for her husband and son. No one in Kanthi’s house has a permanent job; her daughter works as a tea lady for an office in Colombo, and her husband sells vegetables in a cart. Their monthly household income is about Rs. 50,000 and they have to manage their monthly expenses for a family of 7 with this amount.

Kanthi’s single biggest item of expenditure for a month is food. She will usually cook lunch, and have whatever is leftover for dinner. Her lunch usually consists of rice, fish, lentils and whatever vegetables are leftover from the sale of her husband’s vegetables. The cost of these two meals for her family (not including the vegetables she gets from her husband) is roughly Rs.1064 for a day[7],[8]. In addition to this, her grandson will eat pittu or string hoppers for dinner, as he doesn’t have rice for dinner.

The price of this same meal that she cooks for her family would have cost her Rs. 760 in January 2022[9]. This represents a 40% increase in the price of basic ingredients, from January 2022 to May 2022. In addition to this, the prices of food from canteens and small eateries has also had a drastic increase over the past few months owing to fuel price increases, fuel shortages and the rising cost of ingredients[10]. This is likely to have a further burden on Kanthi’s ability to buy food from outside for her grandson.

The current economic crisis has also permeated other aspects of Kanthi’s life. Kanthi used to own a gas cooker, but owing to the danger of the gas cylinder exploding, along with price hikes, and shortages, she switched to making her curries in the rice cooker. However, as rising electricity bills are a consequence of using it, she is also looking at using a wooden stove, although she says she lacks the space to do so, without her house and clothes smelling of smoke fumes.

Her husband, who is a vegetable vendor, has also been affected by the economic crisis. A round trip to the Peliyagoda market in Pettah to buy vegetables that used to cost him Rs.800 in January now costs him Rs. 1100 owing to the price increase of fuel. Additionally, the price of vegetables has also increased due to a limited supply of vegetables coming

into Colombo owing to fuel shortages. This has limited how much he can buy, as many of his buyers aren’t willing to pay higher prices for vegetables. As a result, he doesn’t go to Peliyagoda as often as he cannot afford to, which has a consequential impact on their family’s income.

Kanthi’s generosity is not limited to her family; she also feeds the neighbourhood cats. Their meals usually consist of fish and rice, mixed together with spices, a meal which has also increased in price. The economic crisis has not just affected Kanthi’s cost of living, but also poses a threat to her husband’s livelihood. As the sole breadwinner in the family,

this could, in turn, have serious repercussions on their access to essential items and well being.

Case Study 2: Sumithra

Sumithra became the breadwinner of her family after her husband was diagnosed with Chronic Kidney Disease a few years ago. She has two sons aged 11 and 18. In addition to her job at a women’s cooperative which pays a monthly salary of Rs. 15,000, she supplements her income through a dried fish business, where she packages dried fish at home and supplies to nearby stores. Sumithra spends roughly 75% of the household’s income on food. She cooks rice and curry once a day for both dinner and lunch. This typically includes dried fish, a vegetable curry and another vegetable stir-fried. Dried fish is cheaper and readily available as Sumithra obtains it from wholesalers in Pettah for her business. The cost of the basic ingredients for these two meals alone amount to Rs. 480[11] a day.

Due to the shortage and price of gas cylinders, Sumithra switched to a kerosene stove a few months ago. The cost of kerosene oil is another Rs. 50 per day, bringing the total cost of lunch and dinner to Rs. 530. This means that lunch and dinner account for a monthly expenditure of Rs. 15,900 per month. This is 900 rupees more than her basic salary. It’s important to note that this does not include cooking oil, onions, garlic, ginger, chilli powder, coconuts and other condiments that are essential to the making of the meal. Nor does it include items like bananas, tea and sugar which are regularly consumed.

Sumithra also buys breakfast of bread or string hoppers for her family each morning. Her husband does not eat rice and curry because his health condition has affected his appetite. Instead, she buys him seeni sambol buns or thosai everyday, as that is the only food he finds palatable. For Sumithra, the shocks of COVID-19 and the economic crisis were exacerbated by her husband’s illness which meant a loss of income as well as additional expenses for his medication and dialysis.

As policy discussion shifts towards social security mechanisms and food related interventions to help low-income households recover from the shocks of the economic crisis, it is vital that the unique context of urban households is understood. More broadly, state support at this time should also target a diverse array of interventions in order to account for the dynamic nature of the economic crisis permeating all aspects of life. With the cost of food rising almost daily, a cash-handout alone would not be sufficient, given that the value of money will decrease over time.

Below are a list of immediate term recommendationsa that have been formulated together with community members as well as studying relief measures elsewhere. It must be highlighted that one intervention alone will not adequately support urban households and these recommendations have been formulated on the assumption of a variety of interventions being implemented simultaneously. We also recommend that these measures are universal to every household below a particular income or need threshold and not targeted as that would only exacerbate existing divisions in communities and favour some over others based on political affiliations, ethnicity etc. Furthermore communities are beyond the point of targeted measures and a realistic understanding of the household budget must be reached before determining the threshold. For urban poor households our research shows even those with a monthly income of Rs. 50,000/- are struggling to make ends meet. This understanding will only be reached with meaningful and robust consultations at a community level, and with the active participation of women.

1. Addressing nutrition, not hunger – Approaches to calculating food expenditure must show an appreciation for dietary diversity, cultural practices of cooking, as well the varied nutritional needs and demands of households. Dry rations packs to household alone will not fully meet the nutritional needs of households which will place a burden on the health sector in the longer term. Nutrition levels in children can also be targeted through meal programmes at every school irrespective of whether they previously had a school mid-day meal programme or not. While this would ease the burden on the families who have to send food for their children everyday to school, it would also provide a daily access to nutritious the children may otherwise not receive. The current allocation of Rs. 30/- per school meal is not sufficient to secure a nutritious meal, and should be revised in order to ensure that this meal can account for dietary diversity and cost.

2. Goods instead of cash/vouchers for food – Given the rapid increase in the price of goods, we recommend a system of a basket of goods being available to households as opposed to a certain amount of money/vouchers, as that amount may purchase less and less goods as cost of living increases. If households are guaranteed a certain amount of rice, pulses, vegetables, fruit, milk, eggs every week for at least one year for example, it would enable them to continue to buy the same quantities of food, irrespective of inflation and eat food that addresses hunger such as those that are carbohydrate heavy and instead have a nutritious diverse plate that includes protein and fibre.

3. Distribute locally – In terms of access and distribution, households would prefer to receive these weekly goods through their local community vendors and shops so as to give them business as well as not having to queue up at supermarkets and other outlets every week. This will also ensure that families do not have to travel far to access these goods. Linking these weekly bag of goods to local, smaller scale grocery shops will also help local businesses to stay afloat, whilst also driving community development.

4. Promote sustainable urban gardening – Given the built environment in urban settlements in Colombo, urban vegetable gardening is not a viable option for most communities due to lack of space. However there are innovative ways in which households with small spaces can grow certain type of nutritious food in a small space – such as mushrooms, spinach, tomato, chillies – if such methods and tools can be made accessible to them. Wherever space is available could be used as community allotments as well, but would require a methodical and sustainable engagement with the communities to do so. Methods such as this can help to supplement nutrition, and also improve diversity of diet, mitigating severe food insecurity.

5. Adjusting the food plate – At a time where the concept of a nutritious diet seems almost impossible when people are struggling to even eat a meal a day, targeted information and communication campaigns can better help households to identify meals that are low in cost and high in nutrition. A nutrition awareness campaign can better help households to plan their meals, and to help identify food rich in nutrition, to mitigate against long-term health impacts. Campaigns such as this should run on a range of communication channels (TV, Radio, Facebook, physical posters etc) in order to reach a wide demographic.

6. Monthly cash transfers – Households have needs beyond food expenditure which require cash in hand. These range from rent to utility bills to transport to medicine to children’s education to loans/mortgages to everyday items like soap and clothes. We recommend a minimum of Rs. 25,000 per household per month for at least one year in the form of cash transfers for these non-food expenditures.

7. Lessen the burden – Many urban working class poor communities are struggling to pay utility bills and other debt that have accumulated since the first COVID-19 lockdown in March 2020. These arrears are of such high rates for some families that they will never be able to pay off that debt to the utility companies and the Urban Development Authority. The UDA also takes draconian measures such as cutting off water supply to households in the UDA high-rises flats as a way of making households pay. This places an extraordinary burden on households already struggling to make ends meet, not to mention the effect on people’s mental health. We recommend analysing the various debt to the State across

the various settlements in Colombo and moving towards cancelling the arrears or findings sustainable ways of making those payments.

8. Don’t normalise queuing – Over the last few months, queueing has been normalised especially in the working class poor communities whether it is for fuel, kerosene, gas or food. The State must look at different ways in which gas and fuel for example can be distributed even more locally and using token systems which would mean that people who need fuel, gas and kerosene for their day to day survival would not have to spend an extraordinary amount of hours everyday in queues. This could be done through already existing community/livelihood organisational structures.

Notes: aWhile the measures listed here are ones that must be implemented immediately, there are short and longer term measures that also must be discussed and budgeted for the near future. These include medical needs, passes for public transport, supporting livelihoods (formal and informal) of communities and connecting them to access to finance, markets, new skills and vocations so that they are able to come back to a stable position where they are able to meet their needs without being dependent on State or private support. This also extends to addressing the high rate of unemployment – both from lack of qualifications/skills and lack of jobs – among urban youth

This article and recommendations have been drafted using ongoing (2020 – 2023) research findings and community consultations conducted by the Colombo Urban Lab as a part of two United Kingdom Research and Innovation funded projects. Both research projects focus on challenges faced by off-grid and urban poor communities including access to food systems and housing security. The two projects are led by the University of Edinburgh and the Institute of Development Studies, Sussex and our research partners are located in India, Pakistan, South Africa, Ghana and Zimbabwe. For further information please contact the Director of the Colombo Urban Lab, Iromi Perera – [email protected].

Click here for PDF .of this article.

————-

References

[1] Gunawardhana, N & Ginigaddara, S. 2021. Household Food Security of Urban Slum Dwellers: A Case Study in Colombo Municipality, Sri Lanka. Journal of Agricultural and Food Chemistry 7, pp.34-40.

[2] Weerasekara, P.C., Withanachchi, C.R., Ginigaddara, G.A.S., Ploeger, A. 2020a. Food and Nutrition-Related Knowledge, Attitudes, and Practices among Reproductive-age Women in Marginalized Areas in Sri Lanka. International Journal of Environmental Research and Public Health 17, 3985.

[3] WFP, 2018. Fill the Nutrient Gap Summary Report Sri Lanka. World Food Programme.

[4] Dizon, F. and Herforth, A., 2018. The cost of nutritious food in South Asia. The World Bank.

[5] Central Bank of Sri Lanka, 2020. Annual Report 2020,

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/annual_report/2020/en/13_Box_01.pdf

.

[6] Praneetha Amarasekara, 1st April 2022. Food Inflation Exceeds 30%. Ceylon Today.

https://ceylontoday.lk/2022/04/01/food-inflation-exceeds-30%EF%BF%BC/.

[7] The cost of 1250g rice, 1 coconut, 500g fish, 500g dhal, 200g onion – a requirement stipulated by Kanthi.

[8]As per CBSL Daily Price Report 4th May.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/pricerpt/price_report_20220504e.pdf.

[9] As per CBSL Daily Price Report 4th January.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/pricerpt/price_report_20220104e.pdf.

[10]Charumini de Silva, 28th March 2022, Crises shut over 1,000 bakeries, halve canteens countrywide. Daily FT.

https://www.ft.lk/top-story/Crises-shut-over-1-000-bakeries-halve-canteens-countrywide/26-732667

.

[11]1kg Nadu Rice, 100g sprats, 250g cabbage, 250g beans as per CBSL Daily Price Report May

4th.https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/pricerpt/price_report_20220504e.pdf.

Tags:Colombo Urban Lab.